One Person Company

The concept of One Person Company (OPC) in India was introduced through the Companies Act, 2013 to support entrepreneurs who on their own are capable of starting a venture by allowing them to create a single person economic entity.

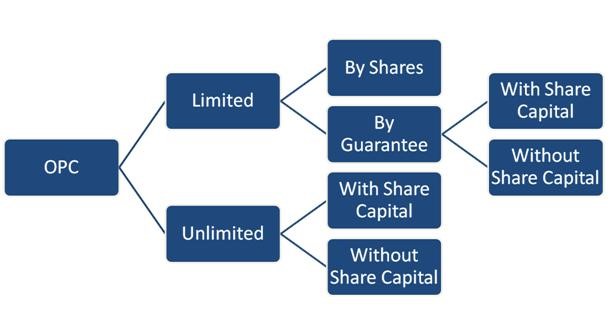

In OPC, a single promoter gains full authority over the company thereby restricting his/her liability towards their contributions to the enterprise. Therefore, the said person will be the sole shareholder and director (however, a director nominee is present, but has zero power until the real director proves incapable of getting into the contract).

BENEFITS OF OPC REGISTRATION

Limited Liability

Continuous Existence

Greater Credibility

How should be the agreement between partners formed?

Partnership deed is an agreement between the partners in which rights, duties, profits shares and other obligations of each partner is mentioned.

Partnership deed can be written or oral, although it is always advisable to write a partnership deed to avoid any conflicts in the future.

Required Documents for Pvt. Ltd. Co.:

- Directors’ Board Meeting minutes

- Profit & Loss Balance Sheet of Pvt. Ltd./OPC

- Conclusions from the Annual General Meeting (AGM)

- Audit report

- DSC of the Directors

- Incorporation documents (PAN Card, Certificate of Incorporation)

OPC Registration Process:

- First the sole shareholder shall get a Director Identification Number (DIN) as well as a digital signature certificate.

- Then he should apply for the name of the company.

- Then he shall file the consent along with the final incorporation forms with the Memorandum and Articles and other required documents.

- After that he should get the consent of the nominee in the prescribed forms.

- After that he shall receive the final incorporation certificate from the register of companies. Now he can commence business under the name.

- Apply for the PAN Number and open a current bank account on the name of one person company.

OPC Requirements:

- Only a natural person who is Indian Citizen and resident in India can incorporate OPC.

- Resident in India means a person who had resided in India for a period not lesser than 182 days in the prior calendar year.

- Legal entities like Company or LLP cannot incorporate a OPC.

- The minimum authorised capital is Rs 1,00,000.

- A nominee must be appointed by the promoter during incorporation.

- Businesses involved in financial activities cannot be incorporated as a OPC.

- OPC must be converted to a private limited company when paid-up share capital exceeds Rs.50 lakhs or turnover crosses Rs.2 crores.

Nominee in One Person Company

The rules for incorporation of one person company requires that the sole member of a One Person Company should include the name of a nominee in the Companies MOA, who will undertake the entity after the expiry or incapacity of the former. Moreover, the document must contain the written consent of the nominee, which must also be filed with the Registrar during incorporation along with the MOA and AOA.