GST RETURNS

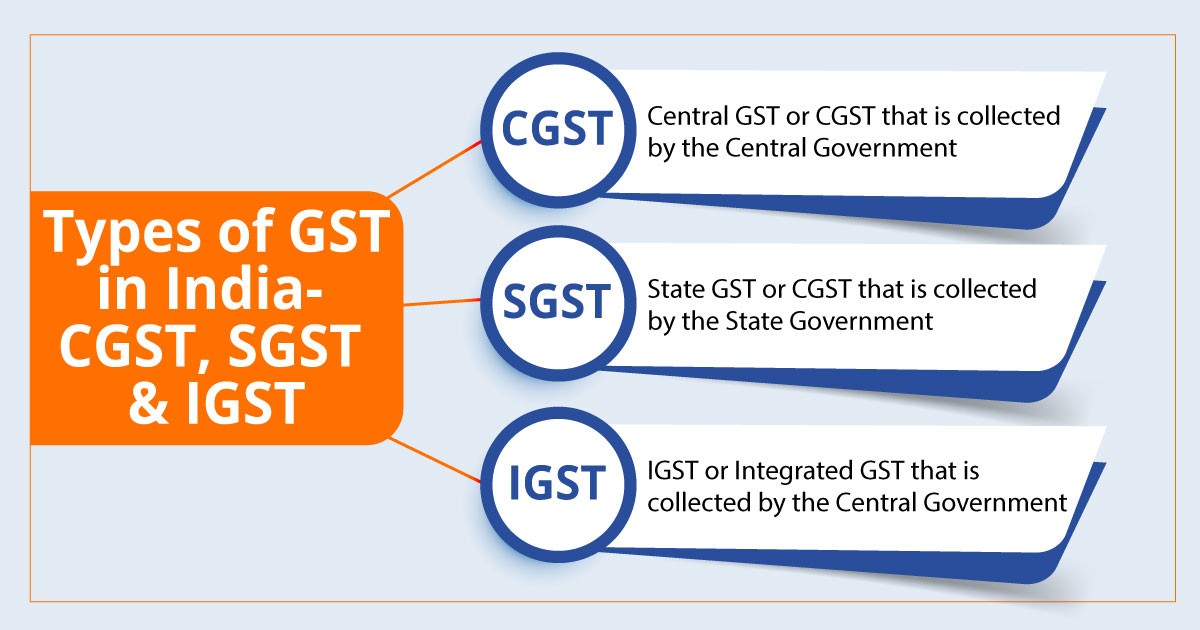

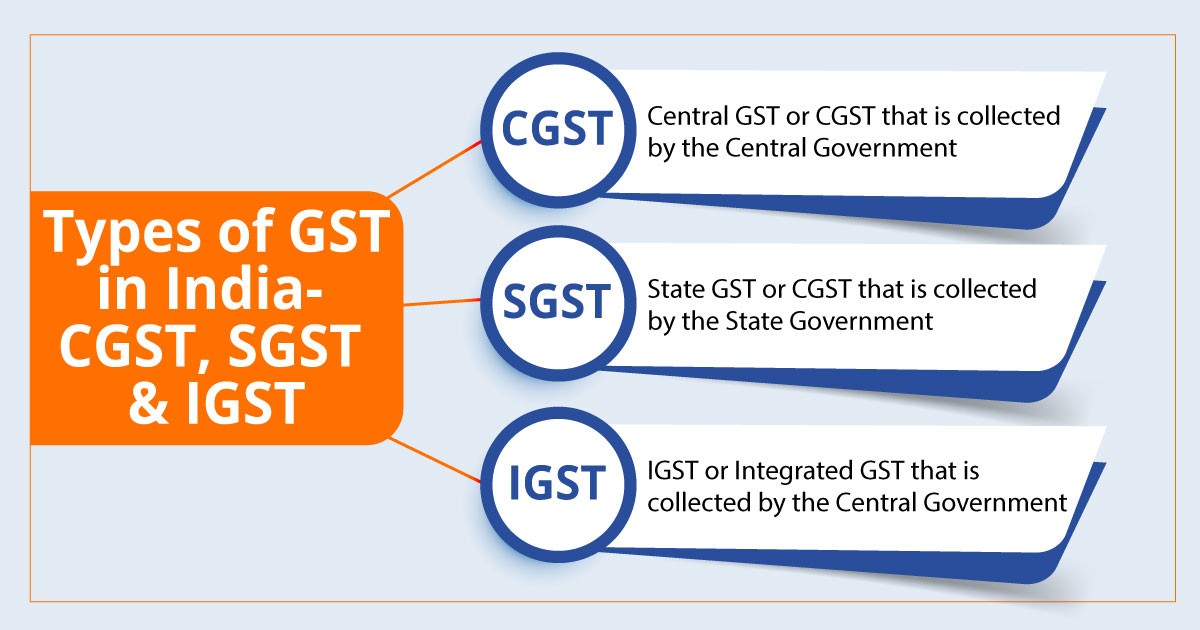

GST is a huge tax reform in India post-Independence. GST is a single comprehensive tax levied on goods and services consumed in an economy. GST is levied at every stage of production-distribution chain with applicable set offs in respect of the tax paid at previous stages. It is basically a tax on final consumption.

GST will simplify indirect taxation, reduce complexities and remove the cascading effect. Under the old system, each taxable event was subject to multiple taxes such as excise, VAT/ CST and service tax. But under GST, products/services will no longer have multiple taxes and there won’t be any requirement to comply with different indirect taxation laws/regulations.

We have a professionalized team handling GST and is always updated with the latest amendments. Our GST’s bouquet of services provides holistic solution in order to enable our client’s to fulfill statutory compliances in a timely and hassle-free manner.

GST RETURNS

GST is a huge tax reform in India post-Independence. GST is a single comprehensive tax levied on goods and services consumed in an economy. GST is levied at every stage of production-distribution chain with applicable set offs in respect of the tax paid at previous stages. It is basically a tax on final consumption.

GST will simplify indirect taxation, reduce complexities and remove the cascading effect. Under the old system, each taxable event was subject to multiple taxes such as excise, VAT/ CST and service tax. But under GST, products/services will no longer have multiple taxes and there won’t be any requirement to comply with different indirect taxation laws/regulations.

We have a professionalized team handling GST and is always updated with the latest amendments. Our GST’s bouquet of services provides holistic solution in order to enable our client’s to fulfill statutory compliances in a timely and hassle-free manner.

Returns to be filed:

Return Form

GSTR-1

GSTR-2

GSTR-3

GSTR-3B

GSTR-4

GSTR-5

GSTR-6

GSTR-7

GSTR-8

GSTR-9

Particulars

Details of outward supplies of taxable goods and services as effected

Details of inward supplies of taxable goods and services claiming input tax credit

Monthly return on the basis of finalization of details of outward supplies and inward supplies plus the payment of amount of tax

Monthly self-declaration that has to be filed

Quarterly Return filed by GST Composition Dealer

Return for Non Resident Taxable person

Return for Input Service Distributor

Return for authorities carrying out tax deduction at source.

E-commerce operator or tax collector should file details of supplies effected and the amount of tax collected.

Registered taxable person should file annual return.

Services by Reliable Innovative

- Registration, modification or amendment under GST Act

- Filing GST returns such as 3B, 1, etc

- Obtaining Letter of Undertaking (LUT) for export of services or goods

- Audit under GST laws

- Attending to the Notices issued under GST Laws

- Consultation and advise on GST matters

- Assisting in obtaining GST Refunds

Services by Reliable Innovative

- Registration, modification or amendment under GST Act

- Filing GST returns such as 3B, 1, etc

- Obtaining Letter of Undertaking (LUT) for export of services or goods

- Audit under GST laws

- Attending to the Notices issued under GST Laws

- Consultation and advise on GST matters

- Assisting in obtaining GST Refunds